The Costs of CO2 Storage

About the report

ZEP is an advisor to the EU on the research, demonstration, and deployment of CCS. Members of its Taskforce Technology have therefore now undertaken a study into the costs of complete CCS value chains. – i.e., the capture, transport, and storage of CO2 – estimated for new-build coal- and natural gas-fired power plants, located at a generic site in Northern Europe from the early 2020s. Utilising new, in-house data provided by ZEP member organisations, it establishes a reference point for the costs of CCS, based on a “snapshot” in time (all investment costs are referenced to the second quarter of 2009).

Three Working Groups were tasked with analysing the costs related to CO2 capture, CO2 transport and CO2 storage respectively. The resulting integrated CCS value chains, based on these three individual reports, are presented in a summary report.

This report focuses on CO2 storage.

Executive Summary

Realistic cost estimates based on ZEP members’ extensive knowledge and experience

As external cost data proved scarce and the development of a generic model prohibitive from a time and resources perspective, this study utilised the technical and economical knowledge of ZEP member organisations who have substantial research and experimental experience in the area of CO2 storage and associated costs. A “bottom-up” approach, based on potentially relevant cost components, was taken and data consolidated into a robust and consistent model.

Thanks to the diverse representation within the group and the use of external parties for review, all data and assumptions were challenged, vetted, and verified – guided by the principle of consensus. Assumptions have also been detailed to facilitate future reference and comparisons with specific projects (see Chapter 2).

The availability and capacity of suitable storage sites proved a key consideration: data were made available from the EU GeoCapacity Project database, comprising 991 potential storage sites in deep saline aquifers (SA) and 1,388 depleted oil and gas fields (DOGF) in Europe. In terms of numbers, the majority are below the estimated capacity of 25-50 Mt, so more than five reservoirs are needed to store the 5 Mtpa reference single stream of CO2 for 40 years, which is assumed to be uneconomical. However, the majority of estimated.

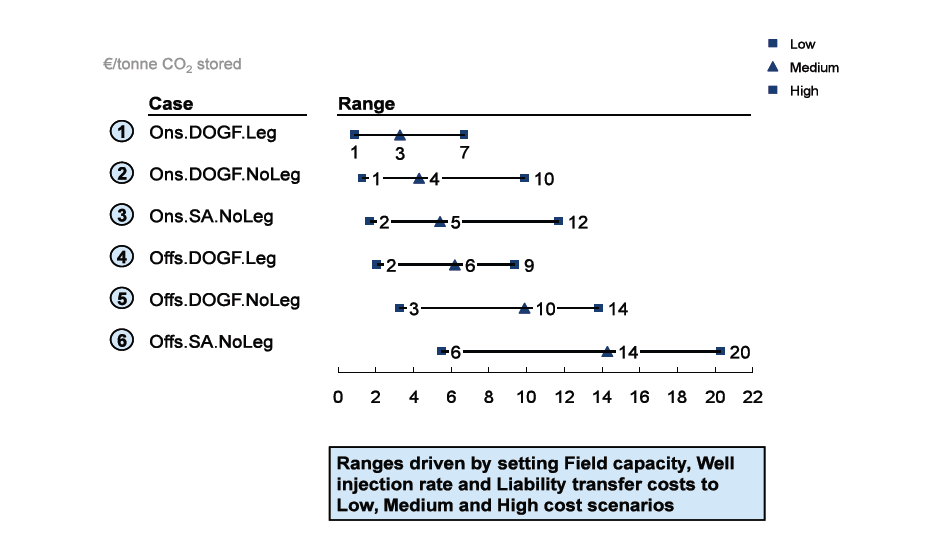

To cover the range of potential storage configurations and still provide reliable cost estimates, storage was divided in six main “typical” cases according to major differentiating elements – DOGF vs. SA; offshore vs. onshore (Ons/Offs); and whether or not there is the possibility of re-using existing (legacy) wells (Leg/NoLeg). N.B. The decision was made to restrict this costing exercise to reservoirs with a depth of 1,000 to 3,000 m.

For each of these cases, three scenarios (“Low”, “Medium” and “High”) were defined to yield a final storage cost range estimate. A cost breakdown for project components/phases is also given and sensitivity analyses carried out to determine which of the 26 cost elements considered carried the most impact on the final cost. To allow a transparent comparison between cost figures for the various cases, a 1:3 source-to-sink ratio was assumed as the base setting in all cases. This may represent a slightly conservative assumption for SAs and is quantified in the sensitivity analysis.

The results

The resulting total storage cost ranges are presented in Figure 1. A key conclusion is that there is a wide cost range within each case, the “High” cost scenario being three to up to 10 times more expensive than the “Low” cost scenario. This is mainly due to natural variability between storage reservoirs (i.e. field capacity and well injectivity) and only to a lesser degree to uncertainty in cost elements.

Despite the wide cost range, however, the following trends stand out:

- Onshore is cheaper than offshore.

- DOGF are cheaper than SA – even more so when they have re-usable legacy wells.

- The highest costs, as well as the widest cost range, occur for offshore SA.

The capacity of storage reservoirs in Europe, according to current understanding, exhibits a mirror image of these cost trends:

- There is a greater storage capacity offshore than onshore, especially for DOGF.

- There is a greater storage capacity in SA than in DOGF.

In other words, the cheapest storage reservoirs also contribute the least to total available capacity.

A sensitivity study was carried out to assess the effect of eight major cost drivers – field capacity, well capacity (injectivity times the lifetime of the well), cost of liability, well completion, depth, WACC, number of new observation wells and number of new exploration wells. The impact of the variations of the remaining 18 cost elements was found not to be significant enough to be taken into account.

These sensitivity studies revealed the following:

- Field capacity has either the largest or second largest effect in all cases – the selection of storage reservoirs based on their capacity is therefore a key element in reducing the cost of CO2 storage.

- Furthermore, well capacity is often an important contributor to variations in cost. Storage reservoir

selection, design, and placement of wells are therefore of key importance for onshore storage. For

offshore cases, well completion costs are the second contributor to variations in cost, reflecting the

specificities of that environment.

Key conclusions

- Location and type of field (available knowledge and re-usable infrastructure), reservoir capacity and quality are the main determinants for costs:

- Onshore storage is cheaper than offshore

- Depleted Oil and Gas Fields (DOGF) are cheaper than deep saline aquifers (SA)

- Larger reservoirs are cheaper than smaller ones

- High injectivity is cheaper than poor injectivity.

- Costs vary significantly from €1-7/tonne CO2 stored for onshore DOGF to €6-20/tonne for offshore SA.

- The cheapest storage reservoirs (large, onshore DOGF) are also the least available as they are not common.

- High pre-FID (Final Investment Decision) costs for SA reflect the higher need for exploration compared to DOGF and the risk of spending money on exploring aquifers that are ultimately not suitable. A risk-reward mechanism must therefore be put in place for companies to explore the significant aquifer potential in Europe.

- Although well costs are ~40-70% of total storage costs, the wide ranges in total costs (up to a factor of 10 for a given case) are driven more by (geo)physical variations than by the uncertainty of cost estimates.

- Because of these (geo)physical variations, there is a need to develop exploration methods that will increase the probability of success and/or lower the costs of selecting suitable storage sites.

- The EU CCS Demonstration Programme is essential, since a number of operational storage facilities will contribute significantly to verifying storage performance. However, likely, the costs per tonne of CO2 stored associated with demonstration projects will be very significantly higher than those for projects in the early commercial phase.