Designing Europe’s CO2 market and infrastructure: A framework for action

This report provides evidence-based recommendations for the forthcoming European Commission’s legislative initiative to establish regulatory certainty for the CO2 market and transport and storage infrastructure. This framework is essential to safeguard environmental goals and economic welfare as Europe’s industrial carbon management industry begins to scale up. The recommendations outlined in this paper aim to ensure the CO2 market enables the necessary infrastructure buildout in line with the European Union’s climate goals.

Executive summary

This report provides evidence-based recommendations for the forthcoming European Commission’s legislative initiative to establish regulatory certainty for the CO2 market and transport and storage infrastructure. This framework is essential to safeguard environmental goals and economic welfare as Europe’s industrial carbon management industry begins to scale up. The recommendations outlined in this paper aim to ensure the CO2 market enables the necessary infrastructure buildout in line with the European Union’s climate goals.

CO2 should be recognised as a commodity, with its value derived from the climate benefit of safe and permanent storage. The market for industrial carbon management is fundamentally different from traditional energy markets and requires a bespoke approach to account for its characteristics. Given that the market aims to deliver climate objectives while interfacing with energy systems, establishing a dual legal basis under both environmental and energy provisions of the EU Treaties is recommended. This will preserve environmental integrity while supporting a coherent market framework.

An overview of the structure of the market and its actors is provided, outlining the complexities that ought to be considered. For example, CO2 storage facilities are context-specific, with risks of an inefficient market more likely to appear in the early phases and competition expected to develop over time. The legislative initiative should therefore aim to be future-proof and allow for regular updates to remain consistent with market developments over time.

Ensuring greater infrastructure access and market liquidity will be essential to accelerate industrial carbon management, and therefore, removing legal barriers to allow for cross-border CO2 transport and storage will be necessary. Moreover, various approaches towards rule-based ownership and provision of access exist. In this regard, key lessons can be learned from other sectors, such as the electricity, gas, and telecommunications sectors.

Planning the European CO2 network should be an important objective of this forthcoming initiative. Various network planning models are in development and exist within EU Member States. Moreover, different regulatory approaches towards CO2 infrastructure have already been taken in Belgium and Denmark, for example. The Commission should ensure that network planning and regulations are harmonised to ensure the CO2 network is resilient and provides fair standards for all market players.

Regulation alone will not make CO2 infrastructure projects bankable. De-risking the financing of CO2 infrastructure projects should be a key priority for the Commission, and the forthcoming legislative initiative should consider available de-risking tools, such as Regulated Asset Base models, carbon contracts for difference, and amortisation accounts, which can help to de-risk investments and attract private capital.

By advancing a clear and comprehensive regulatory framework for CO2 markets and infrastructure, the Commission can help advance the development of industrial carbon management. A careful, balanced approach will be needed to ensure Europe’s climate goals can be met.

Key recommendations

|

Define the CO2 market appropriately |

CO2 differs from other energy market commodities (e.g., gas). Since it has no usable energy value, its value derives from the provision of safe and permanent storage as a service. Any regulation should recognise CO2 management as a commodity, not as a waste, to avoid unnecessary legal barriers. |

|

Establish clear market objectives and a dual legal basis |

The CO2 market should be designed to achieve both economic and environmental objectives. Establishing a dual legal basis, rooted in both Articles 194 (energy) and 192 (environment) of the TFEU, is essential to ensure the legislative framework caters to both objectives sufficiently. |

|

Remove legal barriers and expand the legal basis |

While the CCS Directive provides a clear framework for licensing storage sites, its implementation varies between Member States. Barriers inhibit the cross-border transport of CO2 both within the EU and EEA, and with the UK. Other barriers within the Monitoring and Reporting Regulation should be addressed to ensure coherence within the ICM policy framework. |

|

Account for heterogeneity across the ICM chain |

The legislation should explicitly account for heterogeneity across ICM actors, reflecting the chain’s operational complexity. It must provide clear definitions for all actor types and infrastructures (e.g., treatment nodes) as well as establish flexible rules reflecting the different natures of storage. |

|

Establish adaptive rules for CO2 transport and storage |

Classify each value-chain segment by economic and technical characteristics and adopt proportionate rules following a risk and time-horizon-based approach. Rules governing ICM segments should be future-proof and allow for regular updates to ensure the regulation will be able to react to market development. |

|

Adapt ownership models to the stage of market development |

Various ownership models for CO2 infrastructure already exist for projects that present trade-offs between de-risking projects while ensuring sufficient protection of economic welfare. Given the nascent state of the market, an adaptive approach is needed to ensure the framework addresses the needs of today and can respond to future developments. |

|

Adapt insights from other network industries to the CO2 value chain |

Rather than directly transplanting models and regulatory approaches from other network industries (e.g., hydrogen, decarbonised gases, telecommunications), the legislative framework should adapt their lessons to the specific features of the CO2 value chain – balancing protections against market foreclosure with the flexibility needed to accommodate new business models. |

|

Harmonise national regulations |

The current landscape of the CO2 market and infrastructure regulation and licensing is fragmented, hampering cross-border transport. Harmonising emerging national frameworks, where possible, is crucial. |

|

Enable efficient and resilient network planning |

Several options for the development of a European CO2 network are available. A legislative approach should carefully weigh the different options while ensuring that a resilient network is built out at an accelerated pace, especially in the short term. |

|

Allow for a wide range of financing models | Various financing models have been devised at the national level to scale up the CO2 market. A regulatory framework needs to allow for congruence of these models with EU-level financing. |

Introduction

Advancing the development of a CO2 market and infrastructure is of strategic importance for the European Union (EU) to achieve climate targets, while preserving European industrial competitiveness and economic welfare. Given the time-critical nature of deployment, the regulatory framework must be designed to provide legal certainty, investment clarity, and scalability over the coming decades.

This legislative initiative comes at an important moment as the first full-scale carbon capture and storage (CCS) and carbon capture and utilisation (CCU) projects in Europe enter operation. A robust regulatory framework for the CO2 market and infrastructure can help provide legal certainty, remove existing barriers, and ensure a level playing field for market players. While regulation alone does not guarantee scale-up through investment or public support, it is an important enabler of a competitive European CO2 market by reducing regulatory risk and improving bankability. In a nascent market, a more coherent regulatory framework could reduce uncertainty and beget growth. Further, it complements other legislative instruments such as the Net-Zero Industry Act (NZIA) and provides policy coherence for accelerated clean technology deployment.[1]

However, it is important to note that, by overregulating the CO2 market at such a nascent stage, the potential for investments to be made into projects could be deterred. This may severely limit the deployment of industrial carbon management (ICM) projects unless a favourable balance is struck between ensuring a level playing field and allowing pioneer projects to be developed. Moreover, the CO2 market should not be equated with traditional commodity markets, particularly those in the energy sector. This is because CO2 is not traded because of its energy value, but rather to provide CCS and CCU as a service. While various regulatory approaches can be envisaged, it is essential to recognise the intrinsic role of the EU Emissions Trading System (ETS) within the CO2 value chain.

This report is structured as follows. It first defines the CO2 market and the value of CO2 in an accurate manner, before setting out core objectives to be pursued through the legislative proposal in alignment with the appropriate legal basis. It then provides an overview of the CO2 market, identifying the main actors and potential risks to achieving the objectives. The current legal framework and existing barriers are also assessed, alongside possible options for governance, ownership, and access to infrastructure. Finally, the report discusses approaches to network planning, cross-border integration, and risk allocation mechanisms.

1. Defining the CO2 market

The EU’s renewed commitment to climate neutrality – as reflected in the Industrial Carbon Management Strategy (ICMS), the 2040 Climate Target Communication, and the mission letter for Commissioner Hoekstra – underscores the necessity of establishing an internal market for CO2.[2] A central pillar of this effort is the development of common rules to enable a well-functioning, market-driven CO₂ value chain.

To achieve this, some foundational issues must first be addressed, starting with the question of how to define CO2 within the internal market framework. Carbon dioxide is different from other energy commodities that are traded and regulated at the EU level. While the markets for natural gas or hydrogen emerge due to their intrinsic energy properties, CO2 is not traded for its energy purposes. This means that the market for CO2 does not emerge naturally, except in the case of some uses such as horticulture or the beverage industry. These cases are, however, very limited.

Accordingly, if CO2 is to be recognised and regulated as a tradable commodity, this recognition must be grounded in its role as a by-product of industrial processes and its strategic role within climate policy. This would also be coherent with the EU ETS revision, which considers CO2 flows for compliance purposes. The establishment of a European CO2 market would therefore not replicate existing commodity markets but instead serve a distinct purpose: to underpin the deployment of ICM, with a key focus on CCS and a more limited role for CCU in the post-2040 framework.[3]

1.1. CO2: A tradeable commodity

Waste legislation is essentially designed to regulate materials seen as pollutants, namely, dangerous substances that pose environmental and health risks.[4] Consequently, once a material is legally defined as waste, it is subject to what has been termed an “unsafe area” of regulation, characterised by complex, stringent requirements for its handling, transport, and use under both European and international law.[5]

The definition of waste under most international and regional Conventions has created some legal uncertainty affecting the deployment of CCS in Europe and beyond. However, recent legal developments at both the EU and international levels demonstrate a growing effort to exempt CO2 from its traditional waste classification to recognise the importance of CCS as a climate tool.

The London Protocol, for instance, prohibits the export of waste for marine dumping. However, already in 2009, an amendment was adopted to permit the transboundary movement of CO2 for the purpose of sub-seabed storage under defined conditions. The amendment has yet to enter into force, as it requires ratification by two-thirds of the Parties. In the interim, a 2019 Resolution provides a provisional mechanism, allowing Parties that have deposited a declaration to apply the 2009 amendment to proceed with CO2 export for sub-seabed storage.[6] Similarly, the Baltic Marine Environment Protection Commission (HELCOM), which oversees the governance of the Helsinki Convention, is currently reviewing the implications of offshore CO2 storage with regard to the text of the Convention.[7]

Likewise, at the European level, recently proposed amendments to the Waste Framework Directive explicitly exclude CO2 from the definition of waste when captured and transported for permanent geological storage under the CCS Directive.[8] Taken together, these developments, combined with the economic imperative of scaling up CCS, provide a strong case for the reclassification of CO2 as a networked commodity, similar yet different from electricity, natural gas, and hydrogen.

1.2. The value of CO2

Since CO2 has no usable energy value, its market potential is limited to its management, and the price attached to each tonne to create value. This value can be derived from three main sources:

- Use cases such as horticulture (e.g., greenhouses) or the production of e-fuels, where CO2 is directly bought and sold at a market price. The demand for this is currently limited, hence it falls outside the scope of the current discussion.[9]

- A public value from avoided emissions, where damages from climate change are monetised. However, complexities in attribution and regulatory implications make this approach difficult to use for pricing.[10]

- Carbon pricing, where an EU ETS cap on CO2 emissions creates tradable EU allowances (EUAs). Firms must choose between decarbonising or buying EUAs, which represent the price for one tonne of CO2 in the EU ETS registry.

Of these, the EU ETS is the most relevant for this legislative initiative. Allowances function as regulatory commodities that optimise efficiency by decarbonising where it is cheapest with regard to the price of an allowance.[11] However, the value of allowances does not equal the intrinsic value of a tonne of CO2 and hence does not mirror the carbon price. Instead, it reflects the cost difference between reducing emissions and purchasing allowances.

Further, its value arises from contracts for services, namely the provision of CCS, with some more limited applications within CCU. This underscores that the rationale for the creation of a CO₂ market and infrastructure lies primarily in the delivery of environmental objectives rather than in energy supply. For ICM, abatement costs currently exceed EU ETS prices, resulting in ICM as an additional cost that limits scale-up. Critically, for a CO2 market to emerge, the value of managing CO2 emissions needs to become more competitive than emitting CO2.

When scaling up such a market to the EU-level, it is therefore important that the upcoming legislative initiative takes account of the technical specificities of CO2, its sources of value, its identification as a tradable commodity, and relevant other policies to enable fast and coherent market development. It is also imperative that the upcoming legislative initiative uses a consistent vocabulary to encourage policy coherence and legal certainty. Considering that the aim of the legislative proposal is to create an internal market for CO2, any references to markets, as currently mentioned on the website, should be avoided. After all, the ICM market is just one CO2 market among others, such as the EU ETS or voluntary carbon markets. As the Commission aims at scaling up an internal market for these services, the nomenclature should be clear.

2. Setting clear objectives for the CO2 market and infrastructure

The legislative initiative aims to set clear rules to guide the establishment of a CO2 market and related infrastructure projects. The first step in this process should be defining the overarching objective of this market and the related legislative framework. The forthcoming act should be embedded in, and coordinated with, the ETS, the CCS Directive, the Monitoring and Reporting Regulation (MRR), and the NZIA, operating as a complementary framework that rectifies remaining inconsistencies and secures coherent governance of the EU CO2 value chain.

The EU ETS has been instrumental in pushing forward decarbonisation efforts but has not yet delivered the necessary price signal to incentivise the scale-up of transport infrastructure. Since 2009, the CCS Directive has provided a clear regulatory framework to develop CO2 storage in the EU and the European Economic Area (EEA). Nevertheless, uneven transposition of the Directive has led to a fragmented regulatory landscape for licensing storage sites in Europe.

The NZIA provides a significant impetus for CO2 infrastructure development in the EU. Article 20 provides a legally binding target for annual CO2 injection capacity, and Article 23 obliges oil and gas producers to individually contribute to the development of injection capacity.[12] While central to the development of the ICM market and environmental objectives, this only covers one part of the value chain. Importantly, while the legislative framework for the CO2 market and infrastructure can aid the development of projects by providing greater legal certainty, it is one part of an emerging framework for industrial carbon management that will require greater measures to aid the bankability of projects.

Defining a clear aim for the legislative proposal is crucial, as it determines its legal basis with direct consequences at both the EU and national levels. At the EU level, it shapes the Union’s competence, decision-making procedures, institutional involvement, and degree of harmonisation. At the national level, it will guide enforcement when balancing competing interests, ensuring the instrument’s core purpose prevails.[13]

2.1. Issues with the proposed legal basis

The upcoming legislation should serve both environmental and economic goals, insofar as it is needed to scale up ICM as a key climate mitigation tool, enabling the achievement of EU climate targets while preserving industrial competitiveness amid rising EU ETS costs.

The currently proposed energy legal basis, namely Article 194(2) Treaty on the Functioning of the European Union (TFEU), presents certain challenges since it risks narrowing the ability of the proposal to support ICM as a climate policy tool. As discussed above, the value of CO2 is not intrinsic but arises from the delivery of safe and permanent CO2 storage. This service-based nature of CO2 underscores that the market rationale for the creation of a CO2 market and infrastructure lies primarily in the delivery of environmental objectives rather than in energy supply.

Secondly, the need for regulatory intervention for the setting up of a CO2 market infrastructure would not have emerged without the impetus provided by ambitious climate goals. This is analogous to the EU ETS and CCS Directives, which were adopted to contribute to the fight against climate change and therefore have an environmental legal basis, namely Article 192 TFEU.[14] The link with the creation of a cost-efficient market, as in the EU ETS case, should not obfuscate the real catalyst for this legislation: ambitious environmental goals. Anchoring the upcoming instrument in the same legal basis would ensure policy coherence across ICM instruments. This would align with already existing national legislation, such as the Belgian CO2 Decree, whose legal bases are rooted in the environment (for CCS) and economic competences (for CCU). For this national legislation, energy competence has been explicitly excluded, deemed irrelevant to CO2 transport.[15]

Thirdly, the proposed legislation clearly aims at “removing the remaining barriers and legal uncertainty for cross-border CO2 transportation, such as those originating from international treaties”, such as the London Protocol, the Helsinki Convention, and the Barcelona Convention. All these international treaties belong to international environmental law, since they aim at protecting the marine environment from sources of pollution. If the proposal for an EU CO2 market and infrastructure aims to tackle these specific legal and regulatory issues, an environmental basis would ensure consistency.

2.2. Establishing a dual legal basis

A legally robust solution would be to establish a dual legal basis, thus anchoring a legislative proposal in both energy and environmental competences (Articles 194(2) and 192 TFEU, respectively). The Court of Justice of the European Union (CJEU) jurisprudence allows this when measures pursue two objectives indissolubly linked with each other, provided legislative procedures are compatible.[16] Since both provisions follow the ordinary legislative procedure, a dual basis is legally feasible. This approach, already used for instruments like the Batteries Directive, would reflect the true dual nature of the instrument and provide legal certainty.[17]

3. Addressing legal barriers to the European CO2 market

A key priority for the CO2 market and infrastructure regulation should be to address persistent legal and regulatory barriers where possible, especially those preventing the advancement of CO2 infrastructure projects and the effective functioning of the CO2 market. This section outlines the main ones.

3.1. International law

The international legal framework governing the cross-border transport of CO2 presents a significant regulatory barrier to market development, primarily due to the classification of CO2 as waste. The central legal instrument in this context is the London Convention, which seeks to protect the marine environment by prohibiting the dumping of waste and other materials at sea. The 1996 London Protocol, introduced to modernise the Convention, adopted a “reverse list” approach in Annex I, allowing only specified substances to be considered for dumping.[18]

Since 2006, CO2 streams from carbon capture processes intended for sub-seabed geological storage have been included in this list. However, this recognition did not resolve the constraint imposed by Article 6 of the Protocol, which prohibits the export of waste or other materials to other countries for dumping or storage, effectively blocking the transboundary transport of CO2 for storage purposes. Considering the importance of CCS as a mitigating measure for climate change, an amendment to Article 6 was adopted in 2009, enabling such exports under defined conditions. Following a lack of sufficient ratifications of the amendment, a temporary workaround has been adopted.[19]

In this context, the EU, through its upcoming legislative proposal, has the opportunity to signal an evolution in its classification of CO2, acknowledging its dual relevance as both a private and public good. Given the EU’s status, choices made at Union level could generate spill-over effects, influencing not only the alignment of internal market rules with industrial and climate objectives, but also the direction of international regulatory discussions on CO2 transport and storage.

3.2. European law

Currently, there is no harmonised framework for CO2 regulation at EU level, but rather a patchwork of legal instruments, which have not been designed to support the trade of CO2 as a commodity and thus present criticalities that need to be addressed in the upcoming legislative proposal.

3.2.1. EU ETS Directive

The forthcoming legislative proposal must be consistent with the ongoing EU ETS review, as this alignment is crucial to resolve existing liability ambiguities and ensure future-proof rules governing CO2 transport and storage beyond the EU.

Under Article 49 of the Monitoring and Reporting Regulation (MRR), operators are allowed to subtract from the installation any CO2 emission that is transferred to:

- a capture installation for the purpose of geological storage permitted under the CCS Directive;

- a CO2 transport infrastructure with the purpose of long-term geological storage permitted under the CCS Directive;

- a storage site permitted under the CCS Directive.

This provision raises some regulatory hurdles since Article 49 does not permit the subtraction of the installation emissions when CO2 is captured and transported for utilisation purposes.[20] If an EU ETS installation captures and permanently stores CO2 (either via geological storage or permanent chemical sequestration in a product), the emissions can be deducted from that installation’s surrender obligations, and the carbon accounting is complete.

This results in an inconsistency in how different end-uses are treated and how liability is attributed, even though they will use the same transport infrastructure. As a pan-European CO2 network develops, this narrow definition creates challenges. Transport infrastructure is increasingly used to connect emitters not only to geological storage sites, but also to CO2 users.[21] This shows the need to switch towards a ‘chain-of-custody’ approach that involves every part of the CO2 value chain. This includes the transportation, the refinement, and the end user.[22]

|

Destination after the point of capture |

Liability |

|

Transported to the CO2 storage site. |

Liability transferred to the transport installation and storage site.[23] |

|

Transported for use which intends to use CO2 in a product |

Liability transferred to the transport installation and the user. |

|

Transported for use, which does not intend to use CO2 in a product that meets the criteria of the Delegated Act. |

Liability retained with the emitter. |

Third, the Commission could consider enabling cross-border CO2 transport and storage solutions, since several ICM projects are located outside the EU. As the upcoming legislative proposal is instrumental to the creation of a CO2 market, the need for cheaper storage capacity should play a role. The UK’s shores, for example, have abundant storage potential adjacent to the EU, which is currently unavailable for EU emitters to use for EU ETS purposes. An extension of the scope to cover UK storage sites would enable the market to develop faster. Nevertheless, it is imperative that such a widening in scope is accompanied by legislation ensuring the internal coherence of the CO2 market. Policy coherence, either through congruent bilateral treaties or a holistic multilateral treaty, can act as the foundation for this.[24]

3.2.2. CCS Directive

The CCS Directive (2009/31) has a relatively narrow scope with respect to the CO2 market, as it primarily governs the development of geological storage. Article 21 requires Member States to ensure transparent, non-discriminatory and fair access to CO2 transport networks and storage sites for potential users, balancing open access with environmental protection and system capacity. Operators can refuse access only for justified technical or capacity reasons, but may be obliged to expand infrastructure if economically viable or if a user is willing to cover the cost.

The CCS Directive defines a transport network as pipelines and associated booster stations delivering CO2 to storage sites. This definition excludes other modes of transport, such as shipping, rail, or road, as well as liquefaction devices and temporary storage facilities, which are essential elements of a CO2 transport infrastructure, thus failing to address the evolving needs of the ICM value chain.

The regulatory emphasis of the Directive is on the permitting of site selection, exploitation, and storage, with obligations centred on safety, monitoring, and liability. Its provisions are largely designed to ensure the integrity of storage sites and to manage long-term environmental risks.[25] To ensure a clear, coherent regulatory framework, it may be preferable to amend Article 21 and have it replaced with a dedicated regulation as part of the proposal. Such a move could, for example, still ensure that the award of storage licences is contingent on fair market behaviour.

Furthermore, the fragmented and insufficient implementation of the CCS Directive represents a significant legal barrier, with the potential for obtaining storage licences in many Member States, particularly onshore, currently prohibited. Alignment between Member States could increase effectiveness and allow for improved coherence with the forthcoming legislative initiative as well as the NZIA.

3.2.3. Trans-European Networks for Energy (TEN-E) and for Transport (TEN-T)

The Trans-European Networks for Energy (TEN-E) and for Transport (TEN-T) are central to connecting infrastructure across the EU, yet both frameworks remain inadequate for the development of an integrated CO2 transport market.

Under TEN-E, CO2 infrastructure is limited to fixed infrastructure such as pipelines for geological storage and facilities such as liquefaction plants, buffer storage, and converters for onward transportation.[26] Other essential transport modalities, shipping, rail, and road, are not explicitly recognised as standalone categories, despite their growing role in early CCS deployment.[27]

TEN-T, by contrast, covers these modalities but does not grant CO2 transport projects the same eligibility for Project of Common Interest (PCI) status and the associated benefits, including financial assistance under the Connecting Europe Facility (CEF).[28] This results in a structural imbalance: fixed assets can secure preferential funding, while multimodal projects can only secure funding for fixed installations in the multimodal chain.

4. The functioning of the CO2 value chain

There is considerable heterogeneity in the European CO2 landscape. It is therefore necessary to define both the actors and concepts used throughout this report to fully understand how the ICM value chain functions. For an in-depth discussion of regulatory challenges, see Sections 3 and 6.

4.1. Emitters

Emitters are the first actor, responsible for measuring, reporting, and developing capture projects. Their characteristics differ by production process, capture technologies, CO2 specifications, size, and location. A cement plant, for example, has very different conditions than a waste-to-energy or ammonia facility, which significantly shapes project design and feasibility. A capture installation is defined as any stationary or mobile facility that captures emissions from an industrial emitter.

4.2. Transport

Transport follows capture and may be a single step or split into two. In some cases, captured CO2 cannot immediately enter a transport network due to impurities or risks (e.g., pipeline corrosion). It must first be moved to a treatment or temporary storage node before further transport. A treatment node is an installation, either inside or outside the transport network, where CO2 is purified or conditioned, for example, through liquefaction.

These nodes may or may not be operated by the transport system operator (TSO). Since the market is still developing, TSOs can also overlap with emitters and storage providers. Multiple modalities, such as pipelines, ships, barges, trucks, and rail, constitute actors in the value chain.

Transport modes should also be clearly defined in the regulation. Trucking refers to the transport of CO2 to a storage site or buffer terminal on land. Shipping refers to the movement of CO2 from a buffer terminal to an offshore storage site or to an intermediary storage terminal at sea. A barge is used to carry CO2 along inland rivers to a storage site or buffer terminal. A pipeline refers to both onshore and offshore continuous transport directly to a storage site or buffer terminal.

4.3. Utilisation and storage

The final step divides into utilisation or permanent storage. CO2 may be supplied to users in sectors such as horticulture, e-fuels, or building materials, or it may be injected into geological formations for permanent storage. Storage operators thus form distinct actors with specific technical and legal responsibilities.

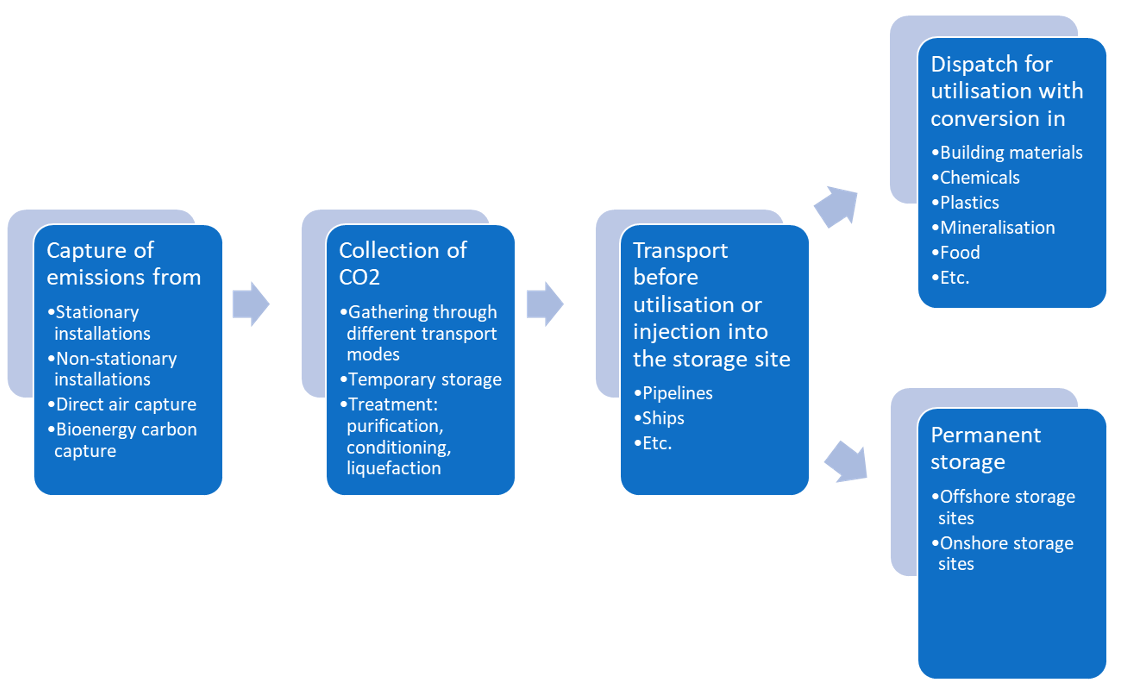

Storage sites differ by geology and location: offshore formations (under the seabed within EEZs or international waters) and onshore formations within national borders. Saline aquifers and porous rock with impermeable caps, for example, provide secure storage options.[29] However, regulatory frameworks should reflect geological differences. Figure 1 provides an overview of the CO2 value chain.[30]

For network planning, infrastructure developers must also be considered as actors, particularly in the nascent stage of the market. Although they may not operate systems, they carry substantial upfront risk and require regulatory recognition. Clear definitions in the legislation provide certainty for emitters and support the choice of the most cost-effective transport solution.

5. Understanding the segments of the CO2 value chain

Different segments of the CO2 value chain display distinct economic and technical characteristics. Some segments behave as natural monopolies, requiring regulatory oversight, while others are competitive and can remain largely market driven. Understanding the different elements of the chain and their economic characteristics is essential to designing proportionate regulation.[31] A natural monopoly arises when overall demand can be satisfied at the lowest cost by one operator rather than by several, regardless of the actual number of market participants.[32]

5.1. Transport

The middle segment of a CO2 value chain, transport connects emitters and their captured CO2 to storage infrastructure. This may involve a single mode or several modes of transport that can include pipelines, ships, trucks, and trains.

5.1.1. Pipelines

Onshore pipelines require large CAPEX combined with very low marginal operating costs, yielding pronounced economies of scale. Rights-of-way and permitting constraints further raise entry barriers and deter efficient duplication. Once constructed, onshore pipelines efficiently interconnect multiple hubs and emitters, reinforcing the cost advantages of a single system. Rivalry in such a market is typically inefficient, and competition for the market or economic regulation is required to protect users. Consistent with this, a recent theoretical study indicates that under certain assumptions, absent of any form of regulation, a private monopoly transports 10% less CO2 than the socially desirable quantity and 10% less CO2 than the socially optimal volume. This inefficiency results in a deadweight loss of between 19% and 29% of the maximum attainable net social welfare.[33] The study does not consider other forms of transport and the competitive pressures that arise from these.

5.1.2. Alternative modes of transport

Other CO2 transport modalities, such as shipping, rail, and road transport, do not display the same monopolistic tendencies. These markets are typically more competitive, with lower entry barriers and greater potential for multiple actors to provide services. These assets are typically modular, mobile, and replicable, while fixed costs are usually lower, and capacity is divisible and scalable, which supports entry and contestability by multiple carriers. As a result, the risks associated with the abuse of market power are considerably lower.

These alternative modes of transport can be competitive with pipeline transport in some cases, leading to greater competition in the market, as outlined in Section 9, and greater resilience in the overall system.

5.2. Storage

The economic structure of CO2 storage sites presents a complex that requires a careful regulatory approach, given that these projects carry high commercial risks. Similar to the early development of electricity and natural gas networks, the CO2 storage sector has high barriers to entry. Maturing storage resources to bankable reserves and operational sites has specific barriers to entry, as these are high DEVEX and CAPEX investments that require significant technical and financial resources to enter the market, particularly due to the stringent permitting procedures laid out in the CCS Directive.[34] However, CO2 storage sites are likely to exhibit significant economies of scale. In practice, a single operator or a few operators could, in some cases, supply the market or large parts thereof more efficiently than many competing firms.[35]

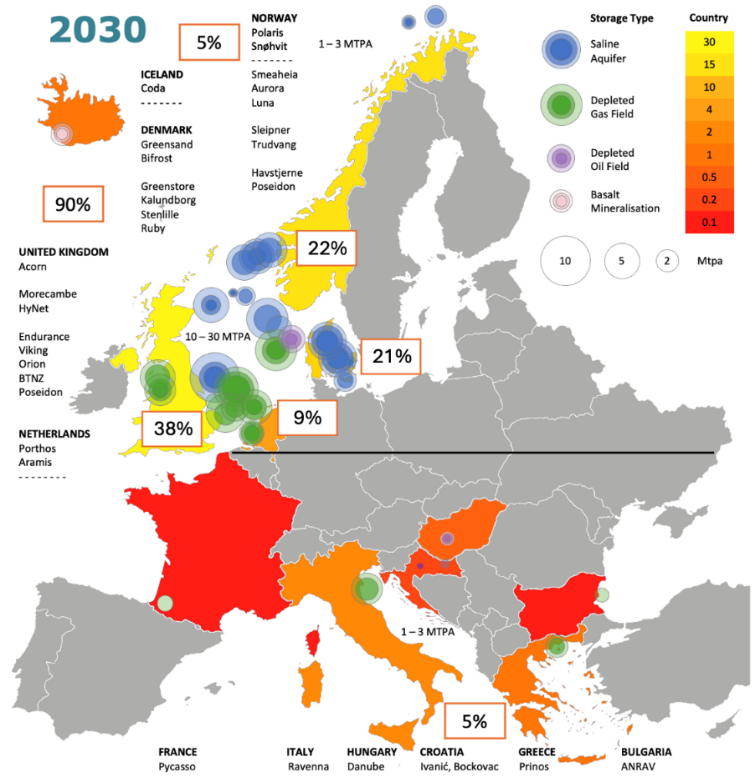

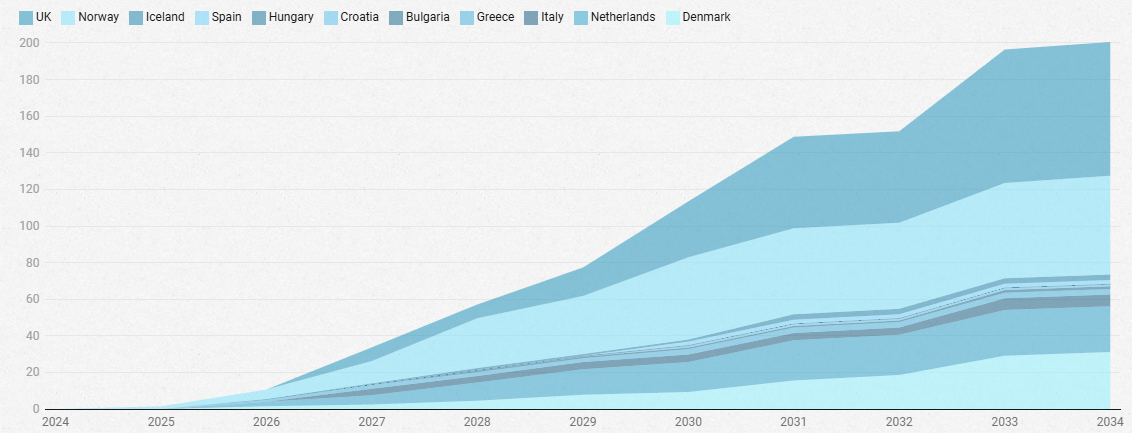

Since CO2 storage must be safe, reliable, and accessible to a broad range of emitters, some form of regulatory intervention is needed to establish fair market conditions for users and providers.[37] Determining the level of regulatory intervention required on the economic activities relating to CO2 storage is complex, given the geographic fixity and geological specificity of storage resources, which profoundly affect their availability for development from resources to operational market reserves and actively injecting sites. This can be due to various factors, such as the availability of nearby emitters or transport infrastructure. For example, Figure 2 above emphasises this point by illustrating projected storage capacity across Europe in 2030.

5.2.1. Assessing the CO2 storage market: Near-term vs. long-term

Furthermore, assessing whether CO2 storage has the characteristics of a natural monopoly or oligopoly should be done so with a clear time horizon in mind.[38] In the long term, i.e., 2040 and beyond, the liquidity of the CO2 storage market should increase, potentially including some aspects of a spot market, with a large tradeable capacity and projects able to cater to a multitude of emitters around Europe. In this case, prices would be more competitive and transparent among all market players.

As a general point, a CO2 storage market that is more liquid and geographically distributed will require significant action from governments. In particular, storage developers will need to be able to apply for storage permits in more countries across Europe. Currently, this is not the case. Additionally, greater efforts will be needed to advance the commercial feasibility of storage sites to aid storage exploration efforts.

5.2.2. Assessing where the CO2 storage market is today

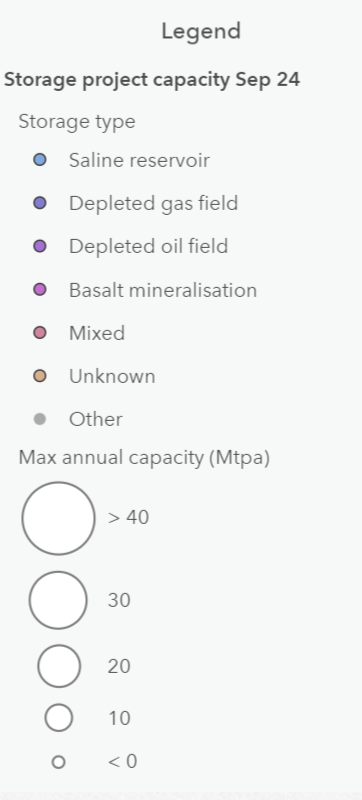

Today, there are dozens of announced projects in Europe, signalling significant interest in developing resources and delivering storage capacity to the market. However, today, the available CO2 storage capacity in Europe is quite limited in size and scope, with three projects operational in 2025 (Sleipner, Snøhvit, and Northern Lights in Norway) and one project planned to commence operation in 2026 (Porthos in the Netherlands). An overview of announced storage projects in Europe is shown in Figure 3. Currently, emitters have limited options for CO2 storage from projects that have taken or may soon take investment decisions.

As the market hopefully develops over time, the necessary level of scrutiny of the storage market will likely decrease. The upcoming legislative framework should be fit for purpose, while additional rules should be made as future-proof as possible and allow for regular updates (e.g., every 5 years) to ensure regulations can respond and react to market developments.

Figure 3: Announced CO2 storage projects in Europe, scaled according to maximum annual injection capacity in MtCO₂/year. Source: Clean Air Task Force.[39]

5.2.3. Relevance of connecting infrastructure for storage

While it is true that the storage market is constrained with several projects likely to be operational in the coming years, various types of storage projects are in development with different forms of connecting infrastructure. This has implications when considering the economic profile of a given storage project and is significantly determined by the transport infrastructure connecting thereto. For example, a recent study indicates that the potentially monopolistic pricing behaviour of storage is much less clear-cut than for pipelines.[40] For example, pipeline-connected geological sites can, in some cases, exhibit some natural monopoly conditions. Their fixed costs, geographic fixity, and exclusive licensing tie emitters to a single reservoir, thus potentially deterring new entrants nearby and making duplication inefficient. By contrast, ship-accessible offshore storage hubs and multi-user clusters may lead to different outcomes, particularly where several sites are located within the economic shipping range, supporting multiple providers to coexist.

In both cases, the length of contracts should also be considered, since today contracts are long-term, usually at around 10-15 years. Over time, this is likely to ease as the storage market becomes more liquid and contract lengths decrease, as has been seen in the LNG market.[41]

It should be noted that the timing of provision is again important, since a well-developed transport network is more likely to have relatively stable unit costs and low-capacity constraints.[42] In practice, CO2 transport in Europe is currently underdeveloped, which results in a relatively constrained marketplace for CO2 storage. Therefore, there is an argument that storage sites connected directly to pipelines may be designated as natural monopolies. This has been the case in the United Kingdom, as further outlined in Section 8.[43] However, storage sites not connected directly to such pipelines are less likely to exhibit such characteristics, and therefore alternative approaches may be more sensible.

6. Ownership models of CO2 infrastructure: An overview

Having established how different segments of the value chain display distinct competitive dynamics, the next question is how ownership is structured across these segments. Ownership models shape how incentives align (or misalign) between capture, transport, and storage, and therefore determine where regulation is most needed to correct market failures.

The allocation of ownership across the CO2 value chain, from capture at the emitter site, through transport, to geological storage or use, varies widely between projects. Models may range from fully unbundled segments, where each activity is undertaken by separate parties, to partially integrated structures combining two parts of the chain, to full vertical integration, where a single entity owns and operates all three elements.

6.1. Unbundled model

In this model, each segment of the value chain is separated from the other segments, which allows for various forms of unbundling.[44] Concerns about the dominance of vertically integrated undertakings can be alleviated as this set-up prevents companies favouring their own affiliates and ensures non-discriminatory consumers. However, there are significant issues, such as potential preventive effects of infrastructure scale-up, as unbundling is primarily applied to developed markets.

6.2. Emitters & transport model

In the Emitters + Transport model, a single entity or consortium owns both the capture facilities and the CO2 transport network, while storage is controlled separately. This setup aligns incentives for capture and delivery, improves bankability through guaranteed throughput, and simplifies operational coordination. However, it creates dependency on storage providers, can discourage third-party access, risks misalignment for other emitters, and requires complex cross-contracting for custody transfer.

6.3. Transport & storage model

In the Transport + Storage model, one entity owns both the CO2 transport system and the storage site. This simplifies contracting for emitters, enables integrated design of compression and injection, and consolidates risk management. However, it also raises potential competition concerns, as the transport operator could tie emitters to its own storage facilities, thereby restricting their flexibility to select alternative storage options or transport modalities.[45]

6.4. Emitters & storage model

The Emitters + Storage model sees one entity controlling capture facilities and the storage site, while relying on third parties for transport. This provides some advantages, including direct oversight of storage operations and flexibility in choosing transport. Risks could be found in pricing and access, presenting a challenge to a fully competitive market, as well as for transport, as this model could lead to holding transport paths captive.

6.5. Full vertical integration

Full vertical integration places capture, transport, and storage under one company or consortium. Benefits include single-point accountability, end-to-end system optimisation, simpler financing, faster decision-making, and fewer disputes. On the downside, the model concentrates all risks in one entity, demands heavy capital investment, risks reduced openness to other emitters, and may face stricter regulatory scrutiny under competition law or access regimes.

These ownership models illustrate the trade-offs between efficiency, competition, and investment risk. Some structures simplify coordination but risk foreclosure; others encourage openness but suffer from misaligned incentives. At present, the number of operational CO2 projects remains limited, thus making it premature to impose overly prescriptive ownership rules. However, analysing emerging models already provides valuable insight into the risks and opportunities that future regulation must anticipate.

7. CO2 infrastructure governance: Exploring regulatory options

Building on the segment-level analysis and the ownership models, this section examines the regulatory approaches available to govern CO2 transport and storage. A central policy question concerns the timing and nature of regulatory intervention: should the CO2 market be subject to ex ante regulation, or is it sufficient to rely on ex post enforcement under EU competition law? On the one hand, a premature imposition of ex ante regulation may unduly influence the competitive conditions taking shape within a new and emerging market. On the other hand, foreclosure of such emerging markets by the leading undertaking should be prevented, and ex-post oversight may prove unsuccessful in detecting violations.[46] Striking the right balance is essential to avoid regulatory bottlenecks that could stifle innovation and investment, while ensuring that market failures do not undermine fair access and cost-efficiency.

7.1. Regulatory precedents in network industries

When designing a regulatory framework for CO2 infrastructure transport and storage, existing regulatory frameworks governing network industries provide useful reference points, but they should not be imported without adaptation. The specificities of CO2, its value chain, and market require a tailored approach. The upcoming legislative proposal should therefore combine short-term safeguards against market foreclosure with long-term flexibility to accommodate evolving business models and infrastructure roll-out. Different network industries use different approaches towards the imposition of regulatory obligations, depending on their market structure, maturity, and policy objectives. Three broad models are particularly relevant, which are illustrated below.

7.1.1. Ex ante regime in electricity and gas

Energy markets, particularly natural gas and electricity, have gradually transitioned from state-run monopolies in the 1990s to an ex-ante regime. This requires stricter unbundling requirements, specifically ownership unbundling as the default model, while allowing for less restrictive ownership models under specific circumstances.[47]

Notably, the process of regulating already well-established electricity and gas networks is very different from the ones at hand, since the regulation will need to be introduced in parallel with the development of the infrastructure itself. This inversion of sequencing requires a more cautious and adaptive framework.

7.1.2. Gradual approach in decarbonised gas and hydrogen

The hydrogen and decarbonised gas package establish a more gradual regime for hydrogen, mandating regulated TPA and tariff, while allowing Member States to maintain negotiated TPA until December 2032 to smooth the transition.[48] While setting a long-term clear ex ante trajectory, it allows for flexibility during the first transitionary period.

Considering that the CO2 market is in its infancy, applying such a governance structure may disincentivise investors from developing projects due to the prospect of limited and uncertain returns. However, this governance could be applied in a functioning and developed CO2 market and could be considered more appropriate in the future.

7.1.3. Dynamic Regulatory Approach in telecommunications

The electronic communications sector illustrates a more dynamic regulatory design. Here, National Regulatory Authorities (NRAs) conduct periodic market analyses to determine whether regulatory interventions are justified. Ex ante remedies are imposed only if:[49]

- High and non-transitory structural, legal, or regulatory barriers to entry are present.

- There is a market structure which does not tend towards effective competition within the relevant time horizon, having regard to the state of infrastructure-based competition and other sources of competition behind the barriers to entry;

- Competition law alone is insufficient to adequately address the identified market failure(s).

If all these conditions are met, the NRA needs to identify any undertaking that holds a significant market power (SMP) within that specific market and possibly impose ex ante remedies such as access obligations, price controls, and transparency obligations.[50]

For CO2 transport infrastructure, this iterative and conditional model could provide a more suitable template in the near term. It would allow regulators to intervene proportionately where monopoly risks are demonstrated, while avoiding unnecessary obligations that could discourage early investment. To ensure consistency across borders and accelerate market development, NRAs could be brought together in a joint regulatory body, similar to the BEREC.[51] in the telecommunications sector, which would coordinate policies and resolve cross-border issues.[52] While this approach would promote aligned incentives and coherent market rules, it may also require significant administrative capacity from NRAs and necessitate new interaction structures among operators, users, and developers to engage with such a “CO2-BEREC”. This trade-off needs to be weighed by the European Commission.

|

Sector |

Regulatory approach |

Key features |

Relevance for CO2 infrastructure |

|

Natural gas and electricity |

Gradual liberalisation from state-run monopolies to strict unbundling. |

Ownership unbundling is the default model, with some exceptions. Regulated third-party access and tariffs. |

Demonstrate how inherent infrastructure monopolies need to be opened over time to guarantee fair competition and prices. However, such a model requires decades to mature and may be premature for the CCS value chain. |

|

Hydrogen and decarbonised gas |

Transitional hybrid regime. |

Ownership unbundling as the default model. Regulated third-party access and tariffs as the standard, while negotiated access remains possible until December 2032. |

Provides a phased approach to market opening. A similar transitional model could be applied to CO2 transport, particularly for pipelines. |

|

Telecommunications |

Iterative approach. |

National Regulatory Authorities conduct periodic market analyses. |

Offers a flexible, adaptive model that is well-suited to the nascent and heterogeneous nature of the CO2 transport and storage market. |

|

No regulation |

No change from the current fragmented landscape. |

Each Member State decides on the unbundling strategy on a national level. Jurisdictions are not harmonised. |

Ability to bundle multiple segments may provide strong incentives for investment, but may distort the market and benefit incumbent infrastructure owners. |

7.2. Regulatory options for access

Access to CO2 transport networks and storage sites is addressed under Article 21 of the CCS Directive, which obliges Member States to take all necessary measures to ensure that potential users can access these facilities in a transparent and non-discriminatory manner. However, the Directive provides only a basic framework, requiring that access be fair and open, while allowing operators to refuse access based on duly justified reasons.[53]

The forthcoming legislative proposal should build on the open-access principles currently enshrined in the CCS Directive and introduce flexible access rules for infrastructure segments, reflecting their inherent heterogeneity.

In practice, this may lead to a choice between allowing for negotiated third party access (nTPA) or regulated third-party access (rTPA), directly impacting tariffs.[54] Notably, within each approach, the level of scrutiny and flexibility can be adjusted based on the market-specificities and goals pursued. Negotiated TPA and tariffs offer commercial flexibility, whereby parties can tailor products and standards to specific chains, often accelerating early projects and leaving room for innovation. However, this carries higher risks of discrimination and foreclosure, opaque pricing, protracted negotiations, and fragmented incentives for investment in sunk-cost assets.

By contrast, regulated TPA and tariffs ensure non-discriminatory access, transparent and predictable cost-reflective tariffs, and cross-border interoperability. Moreover, regulated tariffs enable oversizing/expansion through approved cost-recovery mechanisms such as cost amortisation and mutualisation to steer planning and oversizing (such as in the pipelines case). However, they impose an administrative burden on national regulatory authorities and market players, risks distorting the market, and send weaker signals for investment. If considering rTPA, different design choices could offer different degrees of flexibility, ranging from a minimum intervention regime focused on tariff transparency and methodologies to more prescriptive models, which may result in auctions to allocate access.

8. Current state of CO2 market regulation in the EU and options to consider

The current state of the CO2 market in Europe is a fragmented one. In the absence of EU-level regulation, Member States have devised different regimes to regulate the CO2 market. When designing a pan-European framework, the European Commission should be mindful of already existing national frameworks and try to design rules considering different national architectures. Below, two key elements are outlined, namely national approaches to access to CO2 infrastructure and permitting.

8.1. National approaches to access to CO2 infrastructure

European states have adopted different approaches to regulating access to CO2 transport and storage, reflecting varying policy priorities and levels of regulatory intervention. Disparities can be addressed through a regulation to avoid a fragmented landscape, similar to previous regulatory interventions. The current landscape is detailed below.

8.1.1. Denmark

In Denmark, access is formally open and non-discriminatory, but tariffs are ultimately negotiated with users within published ranges, while the Ministry oversees permitting and ensures appropriate dimensioning of capacity.[55]

8.1.2. The Netherlands

The Netherlands relies more heavily on bilateral contracts: although access is formally grounded in the CCS Directive and competition law, no harmonised tariff methodology exists, and state-owned EBN plays a role in safeguarding public interests.[56]

8.1.3. The United Kingdom

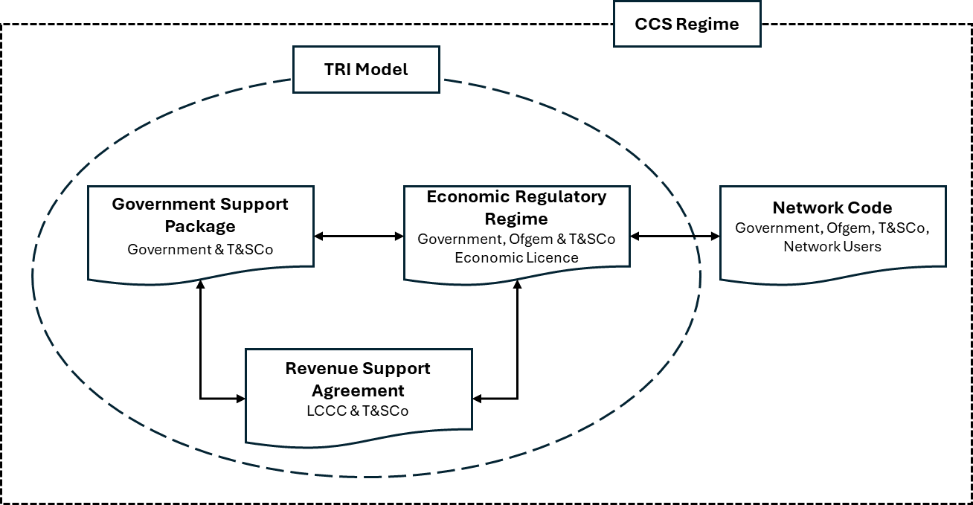

The United Kingdom has chosen the most centralised model, with its CO2 Transport and Storage Regulatory Investment (TRI) model. The latter is based on an economic regulation funding model where Transport and storage companies (T&SCos) require an economic licence to transport and store CO2. The economic licence entitles T&SCos to recover a regulated revenue ‘allowed revenue’ which includes a reasonable return on their capital investment. Access is allocated through a government-led process, tariffs are set under Ofgem’s supervision to provide a regulated rate of return, and network expansion is coordinated through national cluster planning.[57] Notably, the UK has recently launched a call for evidence on CO2 storage, questioning whether the existing RAB model will remain appropriate as the CO2 market evolves. While current networks are recognised as geographic natural monopolies, the government is exploring whether competition may emerge over time, particularly with non-pipeline transport and CO2 storage market.[58]

8.1.4. France

By contrast, the French Energy Regulatory Committee (Commission de régulation de l’énergie) recommended against immediate regulation of CCS infrastructure, due to the high level of uncertainty at this early stage.[59] It thus advises introducing the possibility in the legislation to adopt more invasive regulation (rTPA) for the segments that will likely exhibit monopolistic behaviours, such as pipelines, liquefaction terminals, and storage. Whether to intervene in the market through regulation will depend on a comprehensive analysis, including a study of the profitability of the infrastructure, combined with user consultation and resulting in the publication of regular reports (at least every 3 years).[60]

8.1.5. Flanders (Belgium)

Lastly, the Flemish government opted for a highly regulated model when adopting the CO2 Decree in 2024. Importantly, the decision was taken against the Belgian legal doctrine, which was advocating for a more reactive regulatory approach.[61]

The decision to depart from such a flexible system stemmed from the desire of the stakeholders who called for a regulated approach to attenuate the monopolistic characteristics of transport infrastructure. However, some flexibilities are granted to direct pipelines and closed industrial networks. The Decree recognises two main legal entities: the transport networks and the local clusters.

The local cluster is a pipeline network that transports CO2 from local emitters within a geographically limited area. The network is managed by a local cluster operator, designated by the Flemish government. Meanwhile, the transport network is a cross-county pipeline network aimed at connecting local infrastructures in the Flemish region, but also other regions and abroad. Such a supra-regional network is managed by one entity entrusted with the entire Flemish region.

As far as bundling is concerned, the Flemish system mandates legal unbundling of both local cluster and transport network from EU ETS activities and any legal entity operating a site for consumption,[62] while for liquefaction terminals it only requires unbundling from legal entities engaged in EU ETS activities. Notably, the Flemish unbundling clause does not target geological storage operators, reflecting how bundled transport-and-storage structures are commonplace in pioneer Member States and should thus be allowed within the Flemish region.

Access to a local cluster or transport network is subject to a technical regulation approved by the market regulatory (VREG), which considers the following aspects:

- the conditions aim to ensure fair and open access, with non-discriminatory and transparent access based on approved tariffs;

- the need to take into account the needs of the manager of a local cluster or a transport network that are duly justified and reasonable, and the interests of all other network users of a local cluster or a transport network or the relevant treatment facilities;

- the share of carbon capture and geological storage of carbon dioxide in the total of the carbon dioxide reduction obligations for the Flemish Region.

Taken together, these examples illustrate a spectrum of regulatory models – state-supervised negotiated access (Denmark), contract-based arrangements with state involvement (Netherlands), fully regulated and centralised governance (UK), a wait-and-see, adaptive model (France) and a regional/local approach in Flanders.

8.2. Licensing

For storage, the CCS Directive currently provides a framework for Member States to license the development of storage sites. National competent authorities decide on the issuance of a licence after a technological assessment of the storage site. The Commission must be notified and may issue a non-binding opinion.[63] The technological specifications have been harmonised to some degree. For transport, however, Member States have so far not developed a comprehensive and coherent regulatory framework, leading to a fragmented landscape and an unwillingness to invest in large transport infrastructure projects. Table 3 gives an overview of selected permitting regimes.[64]

|

Country |

Licensing governance |

|

Denmark |

The Ministry must grant licences to establish and operate CO2 pipeline facilities (onshore and offshore), excluding pipelines transiting the Danish Continental Shelf to or from other states. |

|

Belgium |

There is a distinct framework for regional network operators and local branches (accounting separation between these functions is required). A single network operator for each region (Flanders, Wallonia) is appointed by the government. Local and regional operators must be legally distinct from emitters. |

|

Netherlands |

CO2 pipeline infrastructure requires licensing by the Ministry under a general energy and climate infrastructure regime. The Ministry has proposed that state-owned Energie Beheer Nederland cooperate in the development of all CO2 transport (and CO2 storage projects), under market-based conditions. |

|

United Kingdom |

An economic licence to act as a T&SCo is granted by the Ministry and regulated by the energy regulator Ofgem. |

|

Germany |

Under the KSpTG, licences are given by the Federal Network Agency unless the responsibility is transferred to the Federal States Coordination in cross-border projects lies with the Federal Ministry of the Economy and Energy. Pipeline infrastructure is regulated, as are tariffs and capacity allocation. |

Licensing is an issue that the European Commission should consider in-depth in the forthcoming legislative initiative to ensure greater harmonisation and aid cross-border infrastructure projects by avoiding a patchwork of frameworks to emerge across EU Member States. Moreover, slow permitting procedures are a significant burden on industrial actors aiming to develop infrastructure. Clear guidance, also regarding environmental regulations, can expedite this process. Outlined below are three options for the Commission to consider.

8.2.1. National licensing

First, licensing competence and regulations can rest entirely with NRAs. This is a similar option to the storage licensing regime outlined in the CCS Directive. NRAs can give out licences to transport providers, according to the standards set in the specific Member State. Such an approach provides a key advantage for local firms familiar with their specific licensing processes. Moreover, this lowers the administrative burden for NRAs, as they do not have to change their assessment procedures. Disadvantages of this approach arise from a fragmented licensing landscape. As the CO2 transport infrastructure will be cross-border in nature, issues may arise. If a pipeline operator is given a licence in one but not a second Member State, it could lead to delays and financial losses, worsening the risk profile of firms, harming accelerated market scale-up.

8.2.2. Directive harmonisation

The second option is to make use of a European licensing harmonisation for a pan-European transport network. A Directive could be used to provide a baseline for all categories of assessment for CO2 transport pipelines, with NRAs being the last deciding instance on licensing, similar to the CCS Directive. This carries the significant advantage of creating a level playing field across the EU for investors as well as providing regulatory and procedural certainty for investors. This would allow for accelerated market development.[65] Nevertheless, such an approach may give rise to cost risks as well as a need for investors and NRAs to adjust to a new, untested licensing model. Such risks could manifest in market development delays.

8.2.3. Regulation harmonisation

Third, there is the option of enacting a regulation, harmonising the exact specifications for CO2 transport in the EU. Licensing would still rest with the NRAs, which have to adhere strictly to the legislative text provided for in the regulation. Such an approach would have the advantage of local trust in the licensing system. However, the disadvantages of this approach are manifold. Using a regulation would potentially hinder technological innovation and unnecessarily narrow the technological specifications that pipelines can have. Moreover, some cost savings of having Member States give out licences themselves are eroded by the requirement for strict adherence to the legislative text in the regulation. In a geographically diverse Union, this may lead to inefficiencies depending on the exact legislative text.

9. Planning the CO2 network: Options and considerations

One of the key issues for developing a CO2 market is network planning. Defining how and through which modality CO2 is transported from emitter to storage is central to the development of the market for CO2. Prohibitively large costs have been the primary barrier to establishing a European CO2 transport and storage network, especially for smaller players. Efficient network planning can minimise these costs while ensuring that nearly all emitters within Europe are served. Lessons drawn from NZIA corridor planning can ensure a coherent rollout of infrastructure.

The goal of network planning for CO2 transport and storage is therefore twofold. First, any degree of planning serves to minimise costs by avoiding redundant infrastructure, increasing certainty for users and developers, and mitigating cross-chain risks. Second, network planning is crucial in order to reach the environmental goals of the EU.

Despite significant geological potential, there are few projects currently planned in Central, Southern, and Eastern Europe. As outlined in Figure 2, less than 5% of the projected capacity in Europe in 2030 is expected to be located in southern Europe (below the black line). This imbalance ultimately stems from the North Sea’s status as the dominant centre of oil and gas production in the region (as well as experience with CO2 storage), with companies and governments that see a clear opportunity to reuse existing assets and repurpose subsurface expertise and data.

To achieve the goals of environmental and economic benefits, three main considerations need to be recognised by the European Commission.

9.1. Transport modalities

To lay the groundwork for a CO2 market in service of environmental goals, it is imperative that multiple modalities of transport are integrated and a level playing field is established. The transport mode will depend on the geographical location of the emitter and the storage site. While pipelines are the preferred option in many cases, mixed modalities sometimes lead to cheaper and more efficient outcomes.[66]

It is broadly accepted that an onshore pipeline network constitutes a natural monopoly. Other onshore transportation methods, such as trucks, rail, or barges, are naturally more competitive in nature. Offshore transport, i.e., ships and offshore pipelines, differs from onshore market dynamics in some respects. Specifically, offshore transport and storage have the potential to be either a natural monopoly or a somewhat competitive market, depending on the types and quantities of development of transport and storage infrastructure.

The Commission therefore faces the challenge of creating a regulatory framework which enables market development, fosters environmentally beneficial outcomes, prevents anticompetitive behaviour, and ensures a level playing field for all market participants.

Due to the geographically concentrated storage landscape and policy choices of some Member States, costs for CO2 transport are higher for industrial clusters far away from current storage sites. These costs are, however, differentiated among transport modalities. Pipelines have relatively high CAPEX and low OPEX. Trucks, rail, and barges have relatively high OPEX but lower CAPEX. Both CAPEX and OPEX of ship-based transport to offshore storage are medium to high, with OPEX contributing more to the total costs.[67] Such costs often increase significantly along cross-border corridors, necessitating early coordination between competent authorities and governments on both regulatory design and financing instruments.

Being oriented towards both economic and environmental goals, a more open economic regulatory approach could also be taken. This would mean leaving the network planning to market participants and ensuring a level playing field between transport modalities ahead of time. This would entail regulating the onshore pipeline network due to its monopolistic tendency, while leaving other transport modalities less regulated/unregulated. For offshore transport and storage, a separate regulation is likely needed, depending on the injection accessibility, shore terminal market structure and transport options available.

A legislative proposal’s segment on transport modalities, in line with the protection of the single market, should align incentives of all stakeholders along the value chain to ensure that allocative efficiency is maximised and environmental goals are reliably met.[68]

9.2. Standards

Standardisation of CO2 transport in Europe is progressing but currently remains incomplete. The main technical reference is ISO/TC 265, which recently updated its pipeline transport standard, and CEN is in the process of adopting this work for European application. At the same time, CEN/TC 474 is developing standards at the European level. The main problems lie in the absence of harmonised CO2 quality specifications, which complicates interoperability and adds uncertainty to project developers.

The forthcoming legislative initiative should aim to align with ongoing ISO TC265 and CEN TC474 initiatives, while establishing a common safe floor across the EU network to support a coherent, interoperable CO2 transport system. To ensure standards are in line with the latest scientific evidence, periodic reviews may be conducted to update them regularly.

9.3. Resilience

In an uncertain global landscape, the European Commission needs to recognise and discuss the resilience of the planned network. In the event of a (partial) failure of the transport and storage network, alternatives need to be available to ensure both market stability and the safeguarding of environmental goals. Shocks to the system could involve failures (e.g., fugitive emissions) of the transport system or a shutdown due to other exogenous conditions, such as weather in ship-based transport. Important issues to consider are buffer storage, alternative routes, and oversizing.

Buffer storage is already widely used in ship-based transport as the vessels collect the CO2 from the buffer terminal at the shore before delivering it to offshore storage. The inclusion of more buffer storage terminals along the CO2 value chain can also improve the resilience of the entire network in case of short-term, small-scale failure.[69] However, this increases costs for investors. The Commission therefore needs to consider the trade-off between higher up-front costs but more environmental security, or lower network costs with potentially higher future costs for investors and less environmental security in the case of failure.

Buffer storage, by nature, is limited in its capacity. Depending on the technological risk profile of a pipeline network, in some cases, a backup network is warranted. This could take the form of separate pipelines or, for e.g., a mobile fleet of trucks. Preliminary cost assessments have shown that extra costs incurred are not prohibitive to infrastructure deployment and extra buffer storage insure the transport and storage network against technical failures, which would lead to market and environmental failures.[70] Again, the costs and benefits of all options before regulating or planning should be considered.

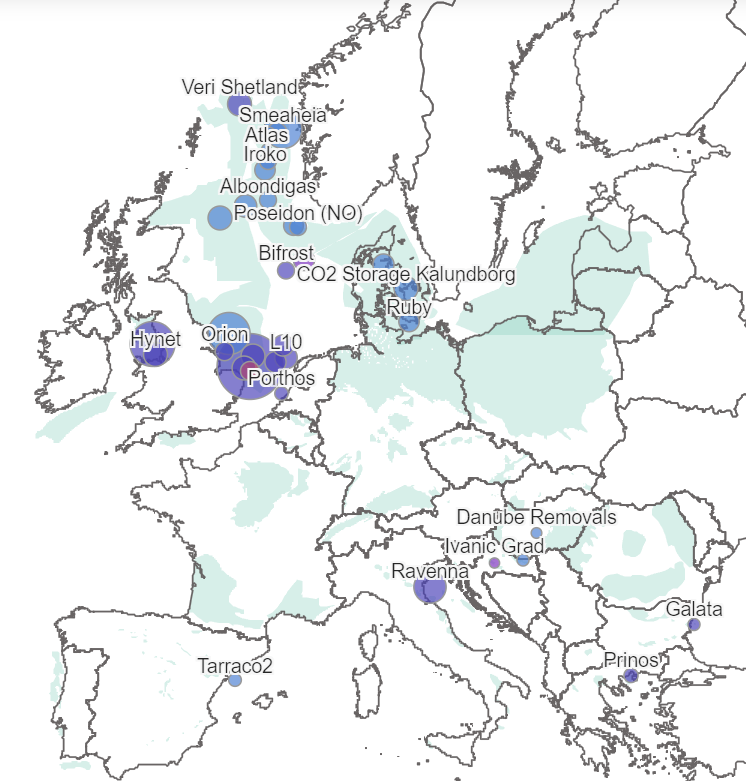

The resilience of the CO2 transport system also entails being prepared for later stages of market development. As shown in Figure 4, the availability of CO2 storage capacity is projected to rise significantly over the next decade.

To deal with these volumes, transport infrastructure – mainly pipelines – needs to be big enough. Pipelines are one-off investments that cannot be swapped out easily; hence, an ex-ante decision to determine size is needed by infrastructure developers. Pipeline costs scale with their diameter, which results in a design dilemma for infrastructure: oversize the pipeline to allow for future demand growth, despite the risk of underutilization and higher upfront costs; or size the pipeline according to current demand, accepting the risk of capacity constraints and costly retrofits if demand increases. Oversizing may nevertheless be preferred due to the potential future benefits, such as a lower levelized cost of CO2, especially in long-distance pipes.

Because oversizing raises upfront CAPEX, affordability for first movers requires complementary cost-recovery instruments: (i) amortisation, which defers a portion of fixed-cost recovery to later periods as utilisation increases, thereby avoiding excessive early-year tariffs; or (ii) cost mutualisation under which the fixed costs of the strategic CO2 backbone are temporarily recovered across other regulated energy networks (e.g., natural-gas TSOs), so that costs are spread over a broader base while the CO2 network scales. Again, careful consideration of this is required when designing a legislative proposal. Including regulation for cost hurdles could overcome this issue.[72]

A further point concerning the development of a resilient grid is to not only address transport segments, but also geological storage. For technical reasons, there is a possibility of storage providers not being able to service their contracted storage capacity. To ensure a robust transport and storage network, balancing between stores is likely to be needed. To pre-empt this and to avoid adverse economic behaviour, the award of storage licences could be made contingent with including a share of permitted capacity reserved for grid balancing, as is currently the case in other network-bound markets such as gas and electricity. This is coherent with the above-mentioned review of Article 21 of the CCS Directive.

9.4. Network planning and infrastructure repurposing

A pan-European CO2 transport network emerges out of the necessity for ICM to achieve climate goals set by the EU. Systems such as the electricity or gas grid first emerged out of broad demand for the transported good. CO2 differs from these commodities in the sense that, once in the CCS transportation, it mostly has no use-value. CO2 is not demanded by households or businesses, but rather by emitters with the aim of storing emissions to comply with climate obligations. The CO2 grid will likely develop in a different manner from other commodity grids, needing a supply-push. The three options below can be considered by the Commission in their proposal.

9.4.1. CO2 Backbone

First, the grid could be developed similarly to the Hydrogen Backbone. The development and planning of the Hydrogen Backbone was a concerted effort between TSOs, the European Commission and the Member States.[73] Large hydrogen corridors and a broader network in all Member States (including EEA) were planned. Such an approach has distinct advantages and disadvantages. Backbone planning through a concerted effort involving all stakeholders of the CO2 value chain ensures planning coherence and, therefore, a high degree of acceptance. Moreover, an ambitiously planned network may induce faster deployment. This results from higher perceived security among stakeholders. On the other hand, a concerted approach comes with a high administrative burden. Further, there is a possibility of financial waste and oversupply, as some Member States are less dependent on transport infrastructure than others. It is imperative that learnings from the hydrogen backbone are incorporated to avoid repeating mistakes should this model be pursued.

9.4.2. Market-based development

The second option is to allow for an iterative, market-based approach. Planning would be undertaken on a smaller level, by industrial emitters or clusters thereof. This usually also involves a degree of centralised information sharing among industrial emitters to avoid unnecessary construction.[74] The advantage of such an approach lies in its simplicity. Low administrative burdens and a focus on larger clusters have a high impact while keeping costs low. The disadvantage of such an approach is that smaller, geographically separated emitters may be delayed in their access to the CO2 transport grid. This could have negative implications for environmental goals as well as their competitiveness.

9.4.3. Coalition-building